CMHC MLI Select: Providing Insight and a Framework

Introduction

On Wednesday, December 1st 2021, Canadian Mortgage Housing Corporation (CMHC) announced that they will be phasing out the MLI Flex financing initiative and replacing the program with an upgraded version that will be known as MLI Select.

This new initiative from CMHC is built for clients that care deeply about providing Canadians access to affordable, sustainable, and accessible housing units across the country. Housing supply in Canada is a key issue that has yet to be solved and CMHC has taken this very seriously, which shows in the roll out of this program. This program’s intention is to help alleviate housing issues by providing incentives to landlords to build and maintain affordable, sustainable, and accessible housing units in Canada.

This article is meant to dive deeper into the MLI Select program and provide guidance for Canada ICI clients for this new initiative. Canada ICI is very excited to begin working with our clients and with CMHC to expand the housing supply of affordable, sustainable, and accessible units in Canada.

Discovery

Since the announcement, Canada ICI has allocated the time and resources to fully digest the MLI Select program. Canada ICI advisors have met with CMHC representatives and have participated in several in-person training seminars, all across the country. During this discovery period, the organization wanted to address additional questions specific to the diverse client base of Canada ICI.

This article is the result of our discovery and a primer on the new program which we are pleased to share.

Overview of MLI Select

While MLI Select resembles the existing MLI Flex program to a certain degree, Canada ICI expects that the MLI Select program will reshape multi-unit financing across the country due to three primary benefits we have identified in the new program:

- A wider application criteria within a streamlined process

- Ability to acquire and refinance existing assets within MLI Select programming

- Expansion of benefits for complying with programming

Application Criteria

The previous program was aimed primarily at solving the affordability challenge facing nearly every Canadian city today.

The MLI Select program differs – though it maintains affordability as a core tenet, the application criteria have been widened to include two other important metrics in energy efficiency and accessibility. Internally at Canada ICI, these metrics are described as “buckets” of social outcomes.

These are:

- Affordability

- Energy Efficiency

- Accessibility

A New Point-Based System

The program is now a points-based system, which leads to a much more streamlined application process. The more committed to social outcomes the developer is, the more points each project receives. In other words, the more affordable, energy efficient and accessible a building is, the more points. The points are directly related to the incentives a developer qualifies for.

There is a minimum threshold required to apply for MLI Select and no maximum amount (although there is no bonus for exceeding 100 points).

These are as follows:

- 50 points

- 70 points

- 100 points

Therefore, a borrower can achieve an MLI Select application approval through more than affordability. CMHC is incentivizing the construction and maintenance of efficient, and accessible buildings as well.

Minimum

Thresholds

Introducing the 100-Point Club

Canada ICI views the point-based system as an excellent way to structure MLI Select applications, and the ability to combine numerous social outcomes is phenomenal. The organization expects that most projects will strive to achieve the 100-point level, given the benefits of that level discussed later.

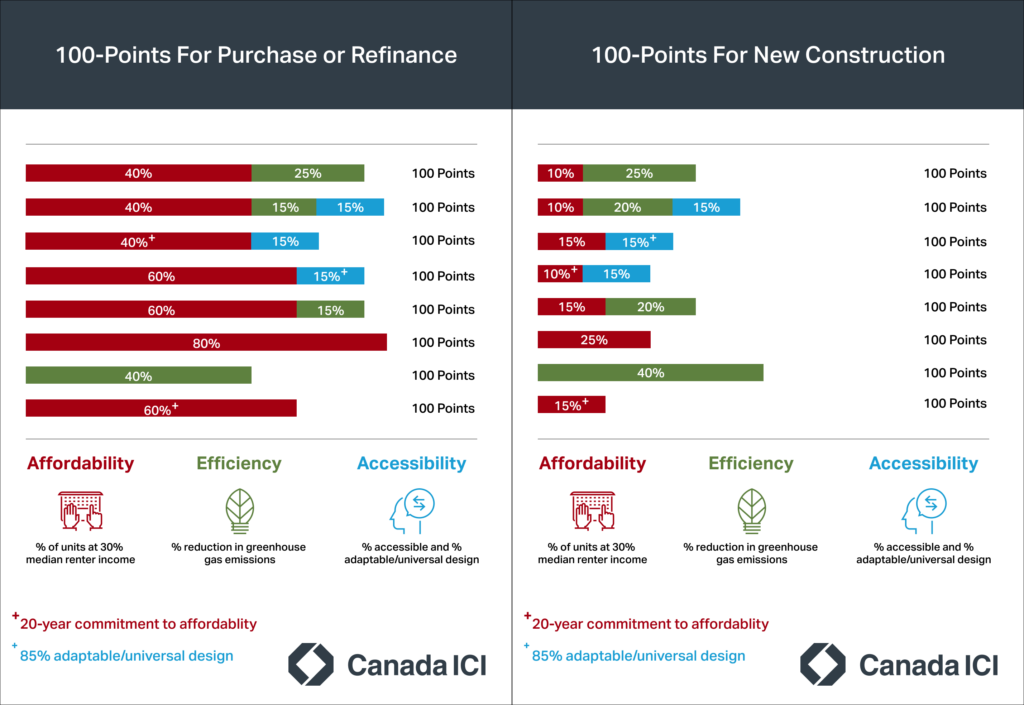

Canada ICI has conducted an analysis to show the different permutations that can result in entering what it calls the 100-Point Club. Here is what it looks like:

We believe it is important to note the following details of the programming in its current form:

- Affordability

- Metric will be required for 10 years

- Bonus of 30 points to be awarded if affordability kept for 20 years

- Energy Efficiency

- GHGs (greenhouse gas emissions) Reductions over 2017 NECB (National Energy Code of Canada for Buildings)/ 2015 NBC (National Building Code of Canada)/ for new construction

- GHGs reductions over current performance for existing products

- Accessibility

- Maximum 30 points for the accessibility bucket alone does not meet MLI Select’s qualifying threshold of 50 points

- There is no bonus for achieving more than 100 points and each point score will be rounded down

- i.e., if the project scores 80 points, the incentives awarded will be from the 70-point bandwidth

- a project scoring 120 points will receive the same eligible benefits as a project scoring 100 points

- No appraisal requirement in determining median income

- The MLI Flex program required an appraisal to determine market rents. The new affordability requirement is the ability to have a certain percentage of the building being leased at no more than 30% of the median renter income in the neighbourhood in which the building is located

- The data for median renter income in Canadian neighbourhoods has not yet been released; however, we are expecting it to be released upon the rollout of the MLI Select program

Refinances and Acquisitions

As noted in the application criteria section, there are three buckets of social outcomes. Canada ICI’s position is that the affordability bucket will be the one that most existing assets will qualify under for two reasons:

- Difficulty in achieving the energy efficiency requirement, cost associated with improving energy efficiency is highly dependable on the historical maintenance and location/climate of a particular asset

- Difficulty in modifying certain existing assets to qualify for the accessibility point system given the large amount of construction work typically required

It is important to note that the affordability requirement will be done on a unit type basis, which means that upper bounds on the rental rate to be charged in the affordable units will be provided on bachelor, 1-bedroom, 2-bedroom and 3-bedroom units.

2021 data is currently unavailable on the CMHC website housing portal; however, as noted above, we believe this data will be provided upon the rollout of the MLI Select program and the borrower can work with their Canada ICI representative to determine if an acquisition or refinance will work within the program.

We expect that many under-utilized existing assets owned by less experienced landlords will qualify for MLI Select and the program provides a great incentive for borrowers to purchase and stabilize these assets to allow the maintenance of affordable rents in the buildings for 10 – 20 years.

Expansion of Benefits

It’s clear that CMHC cares deeply about the social outcomes that are listed in this program, therefore, they are willing to offer some fairly advantageous benefits in exchange for borrowers navigating their projects into MLI Select.

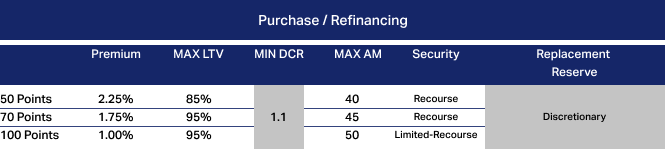

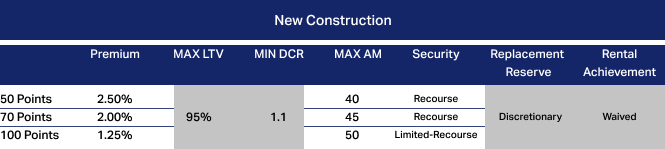

One of the main drivers of applications not being approved for MLI Flex financing was the debt service coverage issue that can result in certain projects due to particulars such as land cost in each market or rising construction costs. CMHC has found an elegant way around these limitations by allowing up to 50-year amortizations if a project achieves 100 points. Canada ICI believes that Canada will likely see a large influx of affordable, efficient, and accessible buildings being built and maintained over the coming years.

Please see below the chart that provides a high-level summary of the benefits for achieving the 50-, 70- and 100-point level in the MLI Select program:

Additional Resources

It’s clear that CMHC cares deeply about the social outcomes that are listed in this program and has created some resources that answer general questions related to the rollout of MLI Select, how it can affect your current or prospective application, and how the program works at a high-level.

Canada ICI announces the appointment of Rick Bachalo as President

Canada ICI, one of the country's leading commercial real estate finance firms, is pleased to announc...

Canada ICI and Dale Anda: Joining Forces to Create a Powerful CMHC Team

Dale Anda and his team are joining Canada ICI. As the newest principal of the organization, this is...

Related Articles