Navigating the Upcoming Changes to CMHC’s Multi-Unit Mortgage Loan Insurance Premiums

Background

As an approved lender, Canada ICI has been informed of significant changes to the Canadian Housing and Mortgage Corporation (CMHC)’s multi-unit mortgage loan insurance premiums this week. As a result of an annual review of insurance products and the adoption of new IFRS 17 accounting standards, CMHC is increasing its premium rates for multi-unit properties.

Key Implications

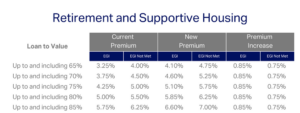

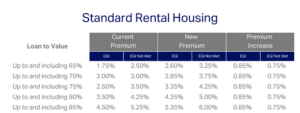

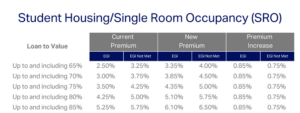

Starting June 19, 2023, insurance premiums for Standard Rental Housing will increase by 0.75-0.85%, while the CMHC MLI Select program will see a 1.55% increase. These premiums are added to the net loan amount and paid down by the asset’s cash flow. Consequently, an increased gross loan amount will reduce borrower cash flow and increase the time it takes to pay off premiums before one begins to pay down the net loan principal.

It’s important to note that there will be no changes to premium surcharges and base application fees.

Transition Period

The increases will take effect on June 19, 2023. Applications submitted to CMHC for a specific borrower on a particular property:

- Before the effective date of June 19, 2023, will be subject to the current premium schedule.

- On or after the effective date of June 19, 2023, will be subject to the new premium schedule.

Schedules

Click and drag to scroll ►

A Proven Track Record

Canada ICI continues to build on its resume of performance with over $7 Billion of transactions across the country in the past 12 months. Working with over 80 different funds, Canada ICI is a results-oriented organization currently one of the country’s top suppliers of CMHC debt across Canada ICI.

FAQ

Why is CMHC increasing its multi-unit mortgage loan insurance premiums?

As a result of an annual review of insurance products CMHC is increasing its premium rates for multi-unit properties, effective June 19th, 2023. The new premium rates reflect the adoption by CMHC of new IFRS 17 accounting standards and related changes. IFRS 17 came into effect on January 1, 2023. The last increase in multi-unit mortgage loan insurance premium was in 2017.

Until what date and time can applications be submitted and still be eligible for the current (lower) premium?

Applications must be submitted before 11:59 pm EST on June 18th, 2023. Applications submitted on or after 12:00 am EST will be processed on June 19th, 2023, and therefore the new premiums will apply. CMHC will use the timestamp on the email containing the application to ensure that the procedure is respected.

An application for multi-unit mortgage loan insurance is submitted to CMHC prior to June 19th, 2023, and then the Approved Lender requests changes to it or provides new information to CMHC on or after June 19th, 2023. Will the application still be eligible for the current (lower) premium?

If the changes requested by the Approved Lender are material and require that the application be re-submitted, the new premium will apply if the application is re-submitted on or after June 19th, 2023.

An application for mortgage loan insurance is declined by CMHC and then changes are made to the application, and re-submitted on or after June 19th, 2023. Will the application still be eligible for the current (lower) premium?

If an application is declined and a new application is re-submitted for the same borrower and property on or after June 19th, 2023, the new premiums will apply.

An Approved Lender cancels a file that is submitted prior to June 19th, 2023. The same file is then re-submitted on or after June 19th, 2023. Will the application still be eligible for the current (lower) premium?

If an application is cancelled and then it is re-submitted on or after June 19th, 2023, the new premiums will apply.

If a post-decision change is requested after June 19th, 2023 and the adjustments change the loan amount, will the current (lower) premium still apply?

If the initial application is received by CMHC prior to June 19th, 2023, the application with a new loan amount will continue to be subject to the current (lower) premiums, provided that the post-approval is accepted by CMHC. However, if the post-decision changes are material and the application requires a re-submission, and this re-submission is done on or after June 19th, 2023, the new premium would apply.

If an application is submitted prior to June 19th, 2023, and it is incomplete (i.e. missing documentation/information), how will this file be treated?

Ideally, the file has all required documentation at the time of submission. Where there are minimal outstanding documents, they must be submitted withing 5 business days of submission. Otherwise, the file will be returned and a minimum of 10% of the fee will be retained. If the documents are received within the 5-day period, the previous premiums will apply. If there is a lot of missing documentation on the application, it will be cancelled and returned to the Approved Lender. If it is re-submitted after June 19th, 2023, the new premiums will apply.

If an application has been submitted and/or approved prior to June 19th, 2023, and then there is a switch of Approved Lender for that application after June 19th, 2023, will the previous premiums still apply?

A switch of Approved Lender should not impact a file approval. However, if the new Approved Lender requires material changes that necessitates a re-submission and the application is re-submitted on or after June 19th, 2023, the new premium will apply.

Do these changes impact other multi-unit insurance fees?

The changes shared through Advice No. 241 only apply to the multi-unit insurance premiums and there are no changes to base application fees, post-decision fees and premium surcharges at this time.

Reignited and Reunited

Read about how Thomas Marcantonio, now of Canada ICI Capital Corporation, measures success as he ref...

CMHC MLI Select: Providing Insight and a Framework

Now that CMHC's MLI Select program is public, Canada ICI has synthesized what this new program could...

Related Articles