Building on Success: A Look Back and Optimistic Outlook for Canada’s Real Estate

Celebrating Teamwork and Partnerships: Reflecting on Canada ICI’s Collaborative Success

The holiday season is a time to appreciate our team and partners’ collaboration with Canada ICI.

I joined the team in September but already had a strong relationship with Canada ICI from my previous role. It all began with a cold call to Jon Veerman, the Director of National Mortgage Underwriting, and was followed by a long sales process that involved discovery, demonstrations, in-person lunches, servicing training, and even a Raptors game where the Toronto Raptors crushed the Charlotte Hornets. Reflecting on my journey, I realize how much can change during the span of an entire year but how little we feel any change day by day. As I look back on the past year, I am very thankful for the opportunity Canada ICI has given me and the fantastic team I work with daily across Canada to serve our partners.

A Personal Journey: Embracing Opportunities and Growth at Canada ICI

From coast to coast, I have enjoyed meeting and hearing from many clients to break bread, collect feedback, and share insights. Often, our conversations turn to market conditions and the opportunities and challenges we will face in the short term. In the long term, we are bullish on real estate in Canada, and it would be foolish not to be given the fundamentals. Investors seek income growth embedded in portfolios, prioritizing stability, predictability, positive cash flows, liquidity, and top-quartile growth profiles. Nonetheless, we face headwinds due to higher borrowing costs, building cost inflation, shortages in skilled trades and fears of economic recession. It’s no secret that Canada has a declining GDP per capita, and the focus needs to be on sectors where we need growth and investment, like real estate, construction, health care and energy. The US economy looks strong on paper, but if spending slows down in 2024, like in Canada, we need to consider that bond yields and interest rates will come down in Canada and the US.

In the long term, we are bullish on real estate in Canada, and it would be foolish not to be given the fundamentals.

–Saeid Khan

Navigating Market Dynamics: Canada ICI’s Bullish Outlook Amidst Real Estate Challenges

As for the tailwinds, Canada has witnessed unprecedented government-driven policy changes for the purpose-built rental housing market. The affordability crisis is a crucial driver of policy decisions, with all three levels of Government and the industry preparing for the boom in affordable housing incentives despite potential inefficiencies in Government spending outweighing the need for more supply. CMHC works with lenders like Canada ICI by providing mortgage loan insurance for multi-unit residential properties, such as apartment buildings, student and senior residences, and affordable housing projects. CMHC also offers various programs and initiatives to support the development and preservation of rental housing in Canada, such as the National Housing Co-Investment Fund, the Rental Construction Financing Initiative, the Seed Funding program, and the MLI Select product. Lenders like Canada ICI can access these programs and products as CMHC-approved lenders and pass on the benefits to their clients, such as lower interest rates, longer amortization periods, higher loan-to-value ratios, and reduced taxes. CMHC also provides market information, research, and analysis to help lenders like Canada ICI make informed decisions and offer the best guidance to their clients.

Advancing Affordable Housing: CMHC’s Role in Shaping Canada’s Rental Market

CMHC programs like Select, RCFI, and future legislative changes will encourage developers to construct more purpose-built rentals, but policy needs to keep pace with challenges and the stresses created by the shortage of rental stock in the market. Federal governments are working together to incentivize development and eliminate HST on qualifying new rental housing projects (apartment buildings, student and senior residences) built between 2023 and 2035, which can lower the cost of a typical construction project depending on multiple factors. Their commitment to add $20 billion in capacity for the Canada Mortgage Bond program to ensure more low-cost, long-term financing for rental projects, and promised to buy up to $30 billion annually in CMBs starting in February 2024, add to that the $15 billion to the Apartment Construction Loan Program beginning in 2025. We source, structure, and manage high-quality commercial mortgages across all asset classes. Most of our business has recently focused on providing CMHC low-cost financing to builders and developers across Canada, so we are closely monitoring policy changes through our nationwide origination and proprietary loan servicing platform. Our national platform continues to be a vehicle for our brokers to innovate and collaborate as a unit, which enables our clients to leverage ICI’s depth of knowledge and experience to outperform the market.

The Canadian government is working to incentivize development and construction. Here is what to expect:

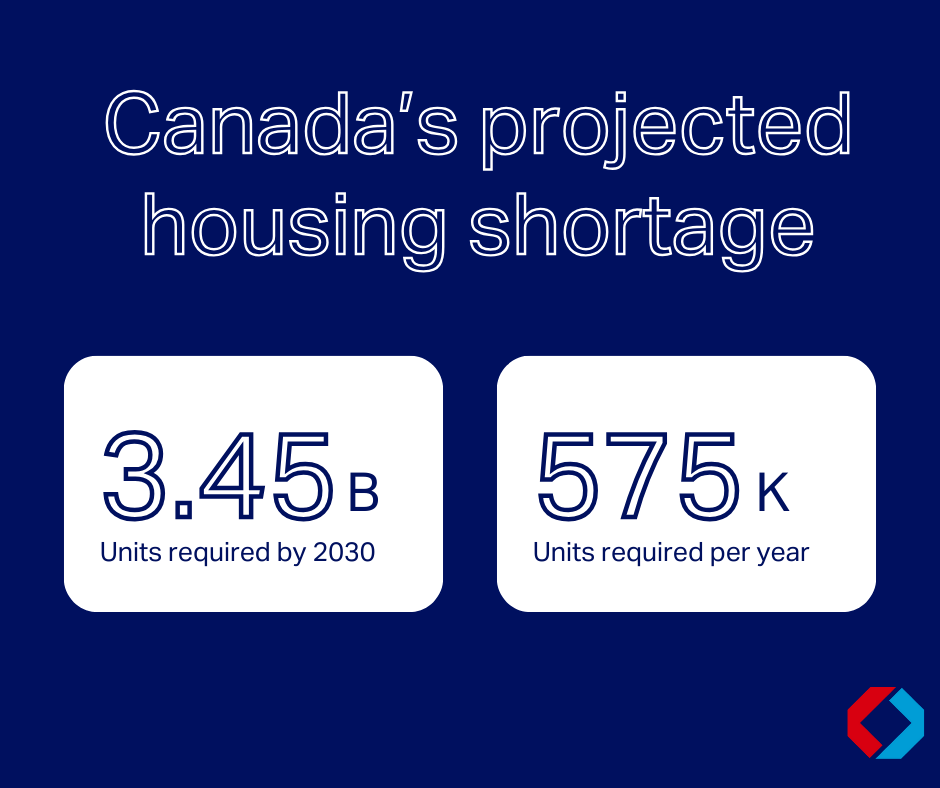

Additionally, CMHC intends to fast-track shovel-ready projects and applications from trusted partners. It is a good thing that we work with some fantastic clients, and as a CMHC-approved lender, Canada ICI is very pleased with that promise and the news that CMHC’s current backlog will be cleared by the end of this year. CMHC is projecting that Canada will need to build an extra 3.45M homes by 2030, but to provide 575,000 homes per year, we will need a transformational approach to city building by reducing the time to construct and streamlining the entitlement process.

Apart from this whirlwind of competing market drivers, one fact stands out: Canada urgently needs new rental housing and is poised to be the hub of real estate activity due to projected population growth and immigration inflows. All forms of Government need to move faster and be aligned if we hope to build enough homes for our Canadian future. The affordability crisis is a crucial driver of policy decisions, with all three levels of Government and the industry preparing for the boom in affordable housing incentives despite potential inefficiencies in Government spending outweighing the need for more supply.

The Office Space Evolution: Post-Pandemic Trends and Repositioning Strategies

It’s common knowledge that the office asset class has been hit hard post-pandemic, and the bleeding will continue with many lenders not even willing to look at new acquisitions and repositioning. However, many corporations have mandated return-to-office plans, a positive force in reviving urban traffic patterns and traditional real estate demand drivers that were absent during the pandemic. However, we must break down office assets by class and market. It is important to note that most of the positive sentiment was observed in most AAA office assets, especially those with transit-oriented locations and amenities supporting collaboration and employee well-being. Most office buildings sit on well-located parcels of land, so many owners are looking at repositioning those assets to their highest and best use. When repositioning B and C assets for residential use, there are many considerations for plumbing stacks, pillars, floor plates, elevators, and significant subsidies for operation. The hope is that advances in building technology will help with these challenges and increase the speed of construction.

2024: A Pivotal Year for Real Estate Decision-Making and Opportunities

What does this mean for you as an asset owner or developer? It means that you have a choice to make: to wait for more clarity or to seize the opportunities in 2024. Some of you have told us that you plan to expand your portfolio, while others have decided to hold off on new projects. We respect and understand both perspectives and provide the proper guidance based on your personal strategy. We have a variety of methods and strategies for helping you with acquisitions, repositioning, refinancings and renewals. With bond yields dropping, mortgage rates typically follow suit. With recent dovishness from the Federal Reserve and messaging from the Bank of Canada on inflation, the cost of borrowing could decrease into the new year.

One thing is sure: with lower and more stable interest rates, we can adjust to a new normal, and it will become more affordable for investors and developers to finance new projects or refinance existing ones.

–Saeid Khan

Strengthening Relationships in Challenging Times

The common theme at every real estate conference across Canada has been that this is the time to “hug thy lender and mortgage broker,” as relationships are more important than ever, given current market conditions. Specialized expertise is critical in navigating opportunities and the challenges of higher financing costs, availability of capital, persistent inflation, negative leverage, and reduced liquidity. We urge you to stay in close contact with your personal Canada ICI advisor during this uncertain time. Doing so will enable us to act swiftly to achieve whatever goals you set for your business. Remember, too, that our efforts are supported by Canada ICI’s market-leading funding and servicing teams, which have grown in recent years to match the scope, scale and sophistication of our great clients.

Holiday Wishes and an Optimistic Outlook From Canada ICI

As we head into the holiday season, I want to wish you and your loved ones a joyful and peaceful time. May this season bring you happiness, rest, and the opportunity to make wonderful memories with those you hold dear. I am excited about the opportunities that await us in the new year. Let’s continue supporting each other, learning from our experiences, and striving for excellence in all we do. Thank you for your invaluable contribution to our success. Here’s to a fantastic year ahead!

Canada ICI Celebrates Global Corporate Real Estate & Facilities Management Award

Last month, Canada ICI received The Corporate Real Estate & Facilities Management Award from the Roy...

Driven to Win-Win

Zero-sum is bad for business. If you work at Canada ICI, the right solution is one where everyone wi...

Related Articles