The Fourth “C” of Credit – COVID

Rethinking the way loans will be underwritten in a post-COVID environment

The effects of the coronavirus on the other three C’s (collateral, cash flow, and credit) have been swift and, in many cases, painful. This pandemic has caused a “reset” in the minds of many Canadian lenders and will inevitably usher in some rethinking of loosening underwriting standards we’ve seen over the last decade.

As with any massive paradigm shift, predicting the new normal is challenging and leads many market participants to pause. For many in the commercial-lending community, their current reality is managing a multi-faceted business while maintaining liquidity, managing the credit risk of their existing book, and figuring out how to operate prudently going forward.

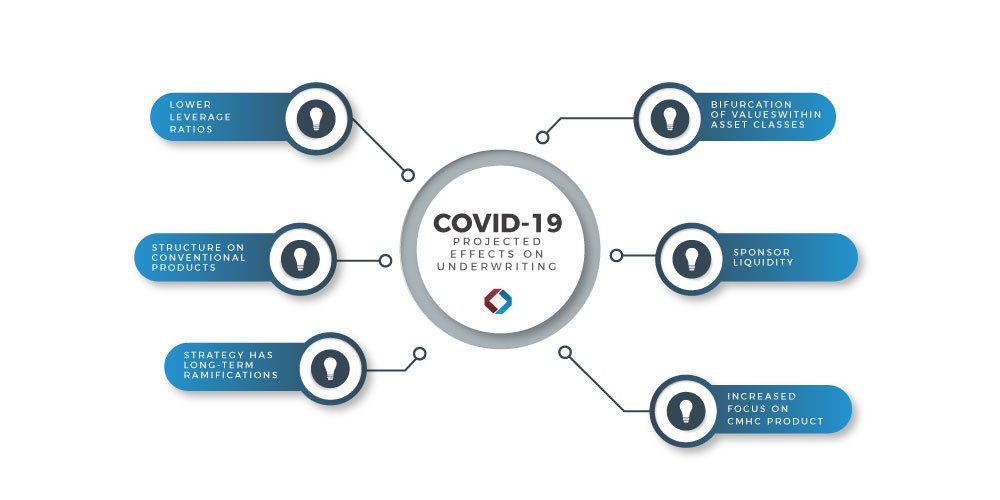

At Canada ICI, we are observing a pullback in the marketplace as many groups work to adjust to the rapidly changing landscape. This hesitation has led to significant near-term changes in underwriting parameters. We believe these changes will persist until there is a clearer picture of when the crisis will end, the economy will reopen, and finally, what the fallout will be. In the meantime, here are some of the downstream changes in underwriting that we could see:

Lower leverage ratios: Asset valuations will continue to be challenging to pin down as it will not be straightforward to ascertain future revenues, vacancies, and cap rates. Until there is clarity on valuations, we expect to see lenders compensate by reducing their maximum loan to value ratios.

Bifurcation of values within asset classes: For the better part of the last 15 years, the risk premium between A’s and B’s has been relatively thin. At Canada ICI, we believe that the lending market becomes hypersensitive to understanding the resiliency of an asset’s tenant base. More resilient and defensive assets will be rewarded with pricing. Pay specific attention to collection ratios (contracted rents vs. actual collections) over the next 120 days and how they differ by asset classes and markets.

“Show me the liquidity” if you want a construction loan: Land and construction financing will be challenging in the near term resulting in more significant equity requirements with more focus on sponsor liquidity and track record. Exit underwriting needs to settle on revenue and expenses in a post-COVID world.

Naughty and nice lists: The Canadian lending market is a relatively small community. A borrower’s conduct on existing loans throughout the recent pandemic will be seared into the minds of lenders for years to come. The borrowers who have been proactive and transparent in communicating actual collections and working with their lenders will build significant goodwill that will pay future dividends. Whether a borrower has previously sought relief or sought a deferral during the pandemic, this will form a part of many lenders’ credit adjudication process on future loans.

A Focus on CMHC products: Canada Mortgage and Housing Corporation (CMHC) has been and will continue to be one of the most reliable vehicles to access multi-family asset capital. Look for lenders across Canada to increase their exposure to CMHC financing.

More structure on conventional products: Traditional balance sheet lenders may look to add more Commercial Mortgage-Backed Securities (CMBS) style features on their loan (i.e. cash-flow sweeps, leasing reserves, earn-outs, cross-collateralization, springing recourse, etc.) to further decrease risk to their loan positions.

Going forward, we expect that the current experiences of lenders will strongly influence post-COVID decisions.

It is difficult to foresee all aspects of potential changes in underwriting criteria. The longer the shutdown persists, the more significant the impact on the economy and, consequently, existing loans. The longer this plays out, the more drastic the future changes will be. The good news is that efforts across the country to “flatten the curve” seem to be working and hopefully will translate into a more stable economic environment sooner than later.

Note: As the pandemic continues, some of the perspectives in this article may fall out of date. This article reflects our views as of April 30, 2020.

Transacting in the Midst of COVID-19

Canada ICI was able to arrange a ~$288mm Construction Loan on behalf of one of Toronto's leading dev...

Commercial Real Estate in the Time of COVID-19

These days, uncertainty is about the only thing we can be certain about. While inboxes are flooded w...

Related Articles